Alpha Fiduciary Quantitative Strategy Fund

AFQSX

A Different Approach to Tactical

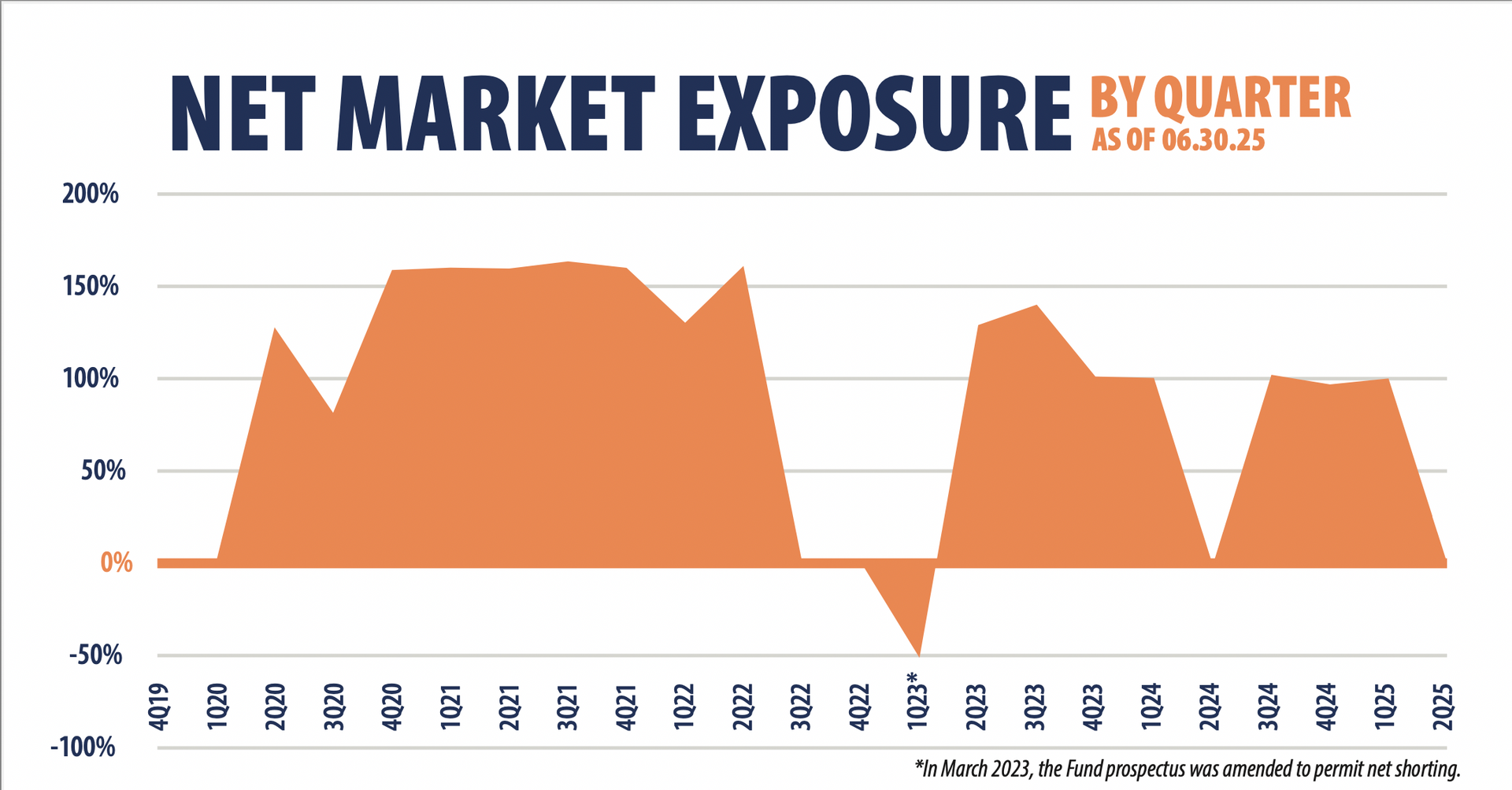

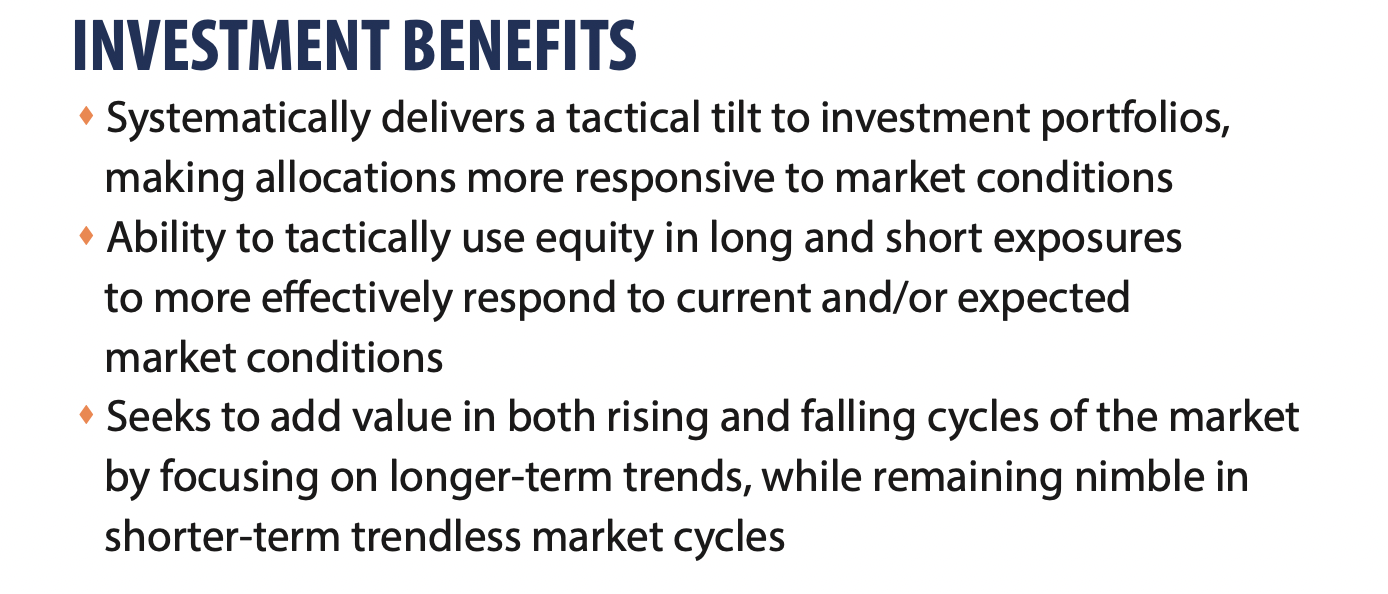

Tactical Funds often focus on managing downside risk; thus, they may underperform in rising markets. However, we believe that we're different in that we seek to add value in both rising and falling cycles of the market by focusing on longer term trends, while remaining nimble in shorter term markets

Opportunistic & Defensive

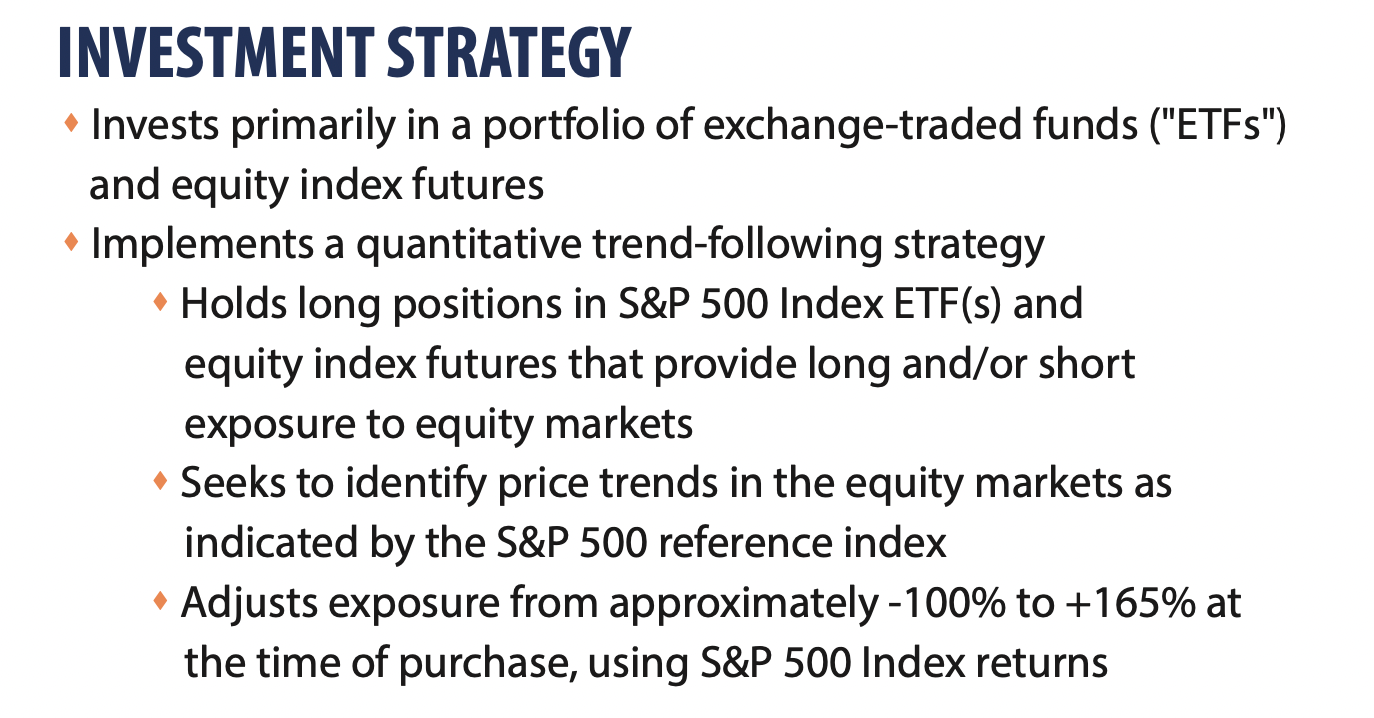

Can increase exposure up to 165% at the time of purchase in rising equity markets by adding S&P futures contracts to our long positions or can move to as much as 100% cash when our models call for a defensive stance. When defensive, rather than selling long positions we sell and/or short S&P futures to obtain our desired equity exposure, potentially increasing tax efficiency to fund shareholders. Can also invest opportunistically in falling markets by adding short S&P futures up to -105%

Tactical Tilt

Systematically deliver a tactical tilt to your overall portfolio making your allocations more responsive to market conditions. Given AFQSX’s -105 to +165% tactical equity exposure, adding AFQSX to your portfolio may potentially improve portfolio upside/downside capture over time. Many investors desire to improve their upside capture during rising market trends, adding AFQSX to their portfolio may help them to achieve this goal.

The Fund

The Alpha Fiduciary Quantitative Strategy Fund is a no-load mutual fund that seeks long-term capital appreciation

How To Invest

The Alpha Fiduciary Quantitative Strategy Fund is available for direct purchase and select brokerage firm

Literature

Details about the investment objectives, risks, charges, expenses, and other important information are contained in the prospectus.

To follow AFQSX on Morningstar, Click Here

To follow AFQSX on Google Finance, Click Here

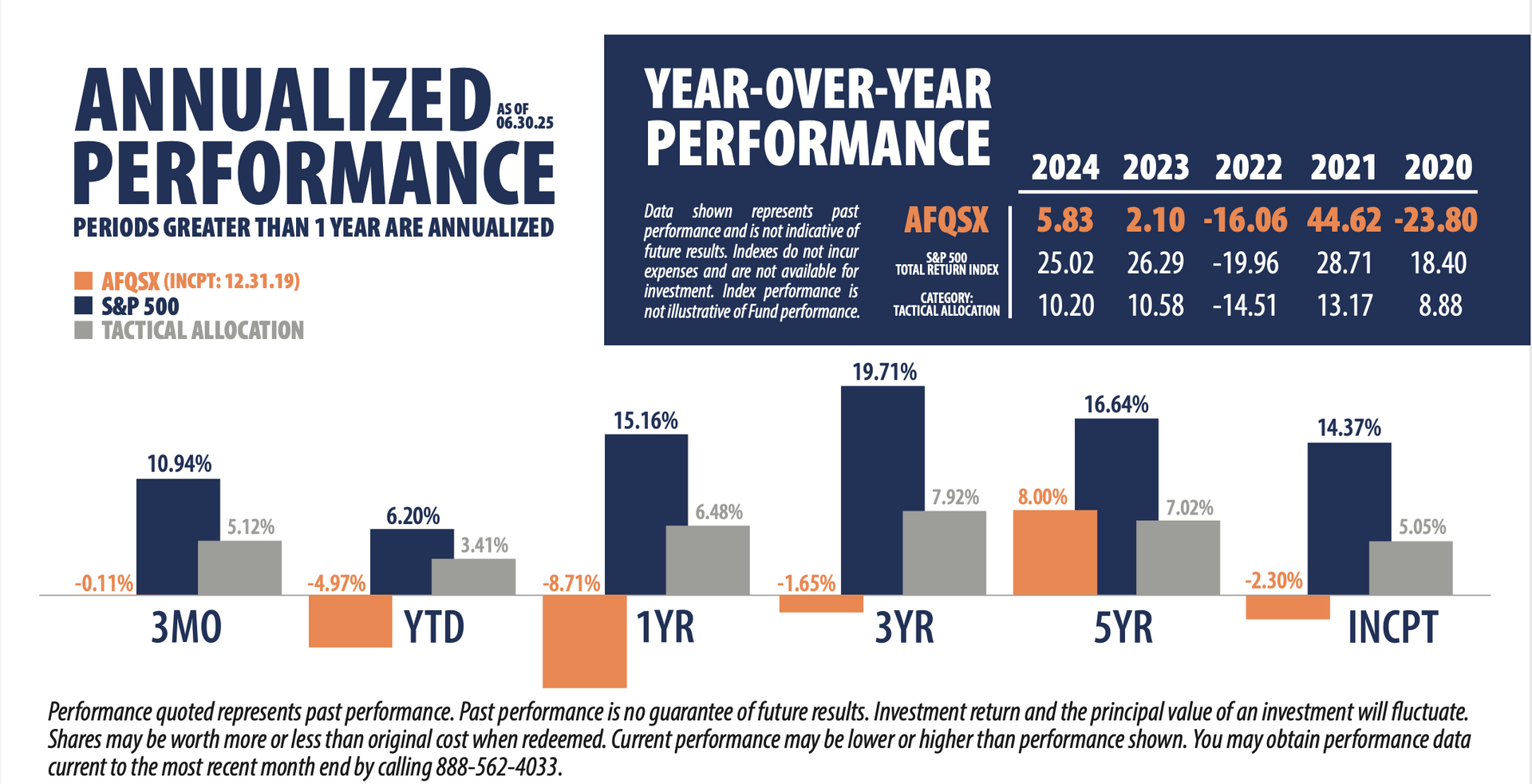

Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the transfer agent at 1-888-266-3996.